What is an Opportunity Fund?

Who Qualifies as an Opportunity Fund?

Opportunity Funds self-certify with the U.S. Treasury Department.

A certified Opportunity Fund invests 90% of its assets in Qualified Opportunity Zones (QOZ) and must verify these ratios with the Treasury Dept. bi-annually.

Opportunity Zone properties must pass these tests:

- Must be in a registered Opportunity Zone

- Must be new construction or…

- More investment must be made in the property than the purchase price.

- A business that receives OZ Funding must be located in an Opportunity Zone and do at least 50% of its business there.

How Do Investments in Opportunity Zones Work?

The Opportunity Zones program provides a tax incentive for investors that can be paired with other tax incentive programs. Programs such as the Low Income Housing Tax Credit (LIHTC) program, the New Markets Tax Credit (NMTC) program, and the HTC, or Historic Tax Credits program

To qualify for the capital gains tax deferral, investment in an Opportunity Fund has to be made within 180 days of the sale of the assets being reinvested.

Opportunity Funds cannot hold investor funds for more than 6 months before investing in an Opportunity Zone and if a person should sell to an Opportunity Fund , they cannot hold more than 20% ownership in that fund.

The State of Opportunity Zones

What Designates an Opportunity Zone?

High need and growth potential. Opportunity Zones contain 24 million jobs and 1.6 million businesses. Many areas have already seen some positive economic growth preceding the 2018 OZ designation.

The Zones are prioritized as high-need with an average poverty rate of nearly 31%, and an average median family income of 59% of the area median (thresholds were set at 20% and 80% respectively.

Older structures offer an opportunity for positive impact. With a median age of 50 years, these neighborhoods urgently need reinvestment.

Between 2018 – 2028: Private investors are eligible for tax benefits in return for investing in low-income communities designated by the governor of every state and certified by the U.S. Treasury Secretary.

Opportunity Zones were created by the Investing in Opportunity Act, part of the Tax Cuts and Jobs Act of 2017. This act received significant bipartisan support and was championed by the Economic Innovation Group, a think tank group out of California.

The Investing in Opportunity Act requested that governors select 25% of their low-income, economically disadvantaged areas as “Opportunity Zones” based on the following thresholds:

-

Median family income of less than 80% of the statewide median

- Poverty rate of 20%

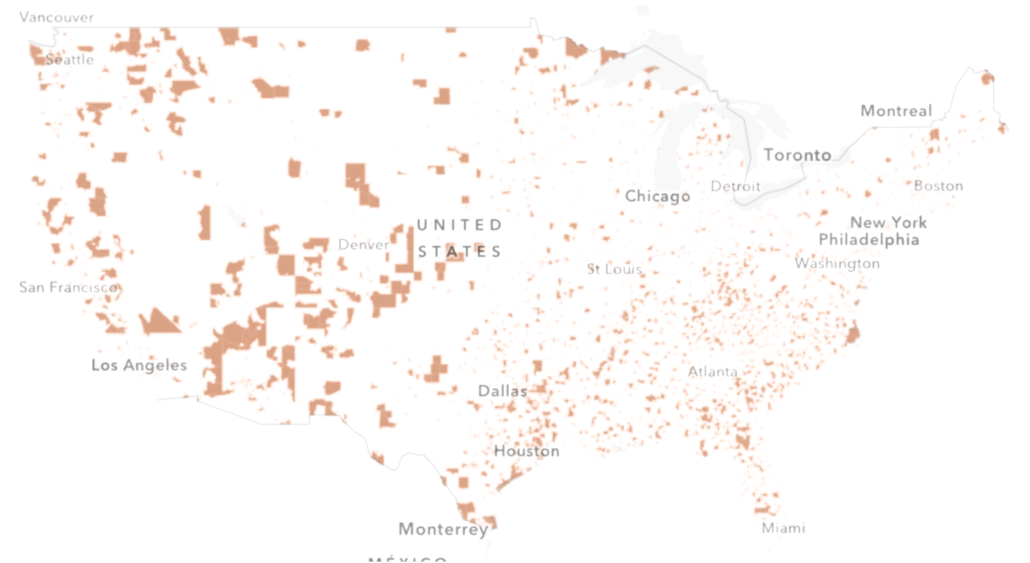

Where are Opportunity Zones?

While Opportunity Zones are found in both urban and rural areas there is a concentration in high-density urban areas.

Opportunity Zone Demographics

Opportunity Zones contain 31.3 million people (*American Community Survey). 56% of Opportunity Zones residents are minorities, compared to 38% nationwide. Many Opportunity Zones are in high-density urban areas offering opportunities to positively impact the urban housing crisis and create business venues for small business owners.

Click to explore opportunity Zones in your area

*powered by eig.org