How to Get a Private Investor to Give Me Money

Although private investors can fund many types of loans, they most commonly fund personal loans and real estate loans.

For business owners, private loans can be an attractive alternative to bank loans as they are time-efficient, flexible, and, in the approval process, often prioritize collateral or projects over credit history.

Read on to learn more about private investors and how to get a private investor to give you money.

What is a Private Investor?

A private lender or private investor uses their private capital to finance investments. Private investors work directly with borrowers and are not affiliated with a financial institution.

In terms of real estate investments, private investors can be used for both long-term and short-term investments. For example, a private investor may:

- Help fund short-term repairs for a flipped property

- Or, provide a long-term investment to give a property a facelift before refinancing into a permanent mortgage

The Benefits of Using Private Investors

Private investors provide quicker approval turnaround and more lenient restrictions when compared to traditional lending options like banks and credit unions. A traditional lender may take weeks or even months to approve a loan, whereas private investors can offer borrowers access to funds within mere days.

Additionally, private investors may prioritize the project or collateral in deciding whether to extend a loan to the borrower, instead of only taking factors such as a poor credit score into consideration.

Now that we’ve covered what private investors are and the benefits of using one, let’s answer the question we all know you came for.

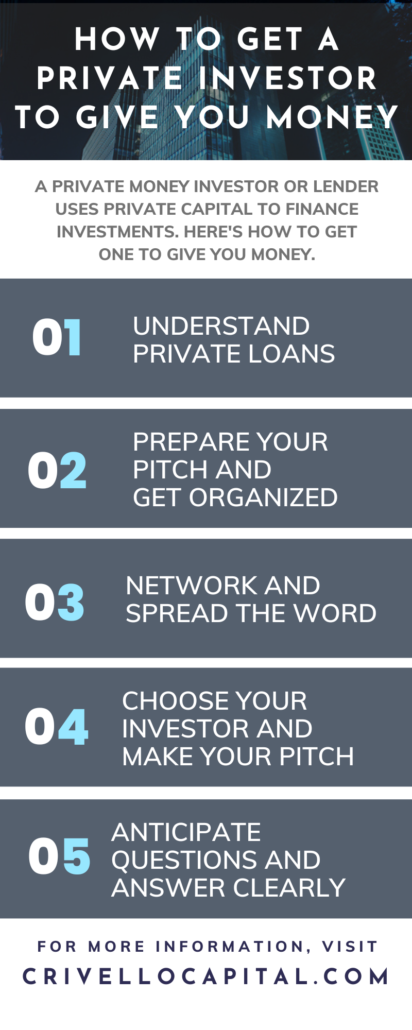

How Do I Get a Private Investor to Give Me Money?

We’ll break down the process of borrowing funds from a private investor into seven simple steps.

Understand Private Loans

First, you need to understand private loans. Private loans work similarly to traditional bank loans: The borrower applies and if approved, receives funding, spends this funding on a specific project, then pays the borrowed amount back in installments with interest.

Organize Your Materials

The borrower should know what financial information the private investor will need to complete a transaction. Have this information organized and readily available for a better shot at getting the money you need.

For example, when it comes to real estate, a private lender would likely want to review the property they’re investing in. The borrower should have these details prepared ahead of time.

Prepare Your Pitch

This is where you create your pitch, which should include a company overview covering your story, education, goals, experience, past accomplishments, and business plan. For instance, if you are a pro house flipper, you should consider including successful property flips in your pitch.

Network and Spread the Word

When researching private investors, you may notice the terms ‘primary circle’ and ‘secondary circle’ thrown around. These terms suggest that many private investors personally know the borrowers through friends or family before they make a deal.

Choose Your Private Investor and Make Your Pitch

Unlike banks, private investors work directly with borrowers. This arrangement means the relationship between the investor and borrower is important. Do your research to find a few investors who might be a good fit for your business.

Anticipate Questions and Answer Clearly

Surely, the prospective investor will have questions.

The private investor may be concerned with profit splits, timelines, or the details surrounding the process of the loan. The investor may ask questions such as:

- How much money will you need?

- How will you use the loan?

- How will you repay the loan?

- Does your business have the ability to repay the loan and the interest?

- Have you taken and paid back similar loans in the past?

- What does your credit profile look like?

- Can you put up any collateral to secure the loan?

When questions are asked, provide clear, confident, and honest answers. Don’t sweat it–you’ve prepared in advance.

Looking For a Private Investor?

Crivello Capital is a private investment group focused on making communities better and impacting the lives of business owners through capital investment. Read on to learn how we can help you build your business.