Opportunity zone (OZ) investments have an array of pros, ranging from deferred or reduced capital gains tax to tax-free appreciation. However, as with any investment, opportunity zone funds also have a few cons, such as a limited track record and a high buy-in.

The Tax Cuts and Jobs Act of 2017 created opportunity zones to spur development within these communities through incentivizing investors to invest capital into them. Taxpayers may defer tax on eligible capital gains by investing in a Qualified Opportunity Fund and meeting the associated requirements.

Read on to learn more about the pros and cons of opportunity zone investments.

What is an Opportunity Zone?

An opportunity zone (OZ) is a community with economic disadvantages. The federal government recognizes this community as low-income and in need of an influx of capital.

The purpose of OZs and their associated tax incentives is to encourage long-term investments in distressed communities. These investments can lead to an increase in local jobs and economic growth.

Read on to learn how to attract investors to your opportunity zone.

What is a Qualified Opportunity Fund?

A Qualified Opportunity Fund (QOF) is an investment vehicle organized to drive investment in OZs. When investors put capital into the fund, the community is revitalized with the funds and the investor can defer tax on eligible gains.

What are the Pros of Opportunity Zone Investments?

Since their origin following the Tax Cuts and Jobs Act of 2017, opportunity zones have proven to have a few pros. In this list, we’ll discuss some advantages for both the investor and the community.

Deferred Capital Gains Tax

Capital gains are a constant in the investment world. However, OZs provide investors with a loophole that allows them to defer capital gains taxes and use the investment to instead generate passive income.

If the investor makes an investment into a QOF within 180 days of incurring capital gains, they can defer the tax on the invested amount until 2026.

Reduced Capital Gains Tax

Investors can reduce capital gains by staying with qualified OZs projects for years. For instance, a five-year investment reduces the original amount taxed for capital gains by 10%. If the investor keeps the money in the QOZ fund for an additional two years, the capital gains reduction increases to 15%.

Appreciation Without Taxes

If investors keep their investments in the fund for 10 years, the appreciation in the opportunity zone fund investment is not subject to capital gains tax. To clarify, investors must still pay the taxes on the funds from the original investment but there are no additional taxes on the profits derived from the opportunity zone project over the decade.

Opportunity Zones Help More Disadvantaged Communities Than Past Programs

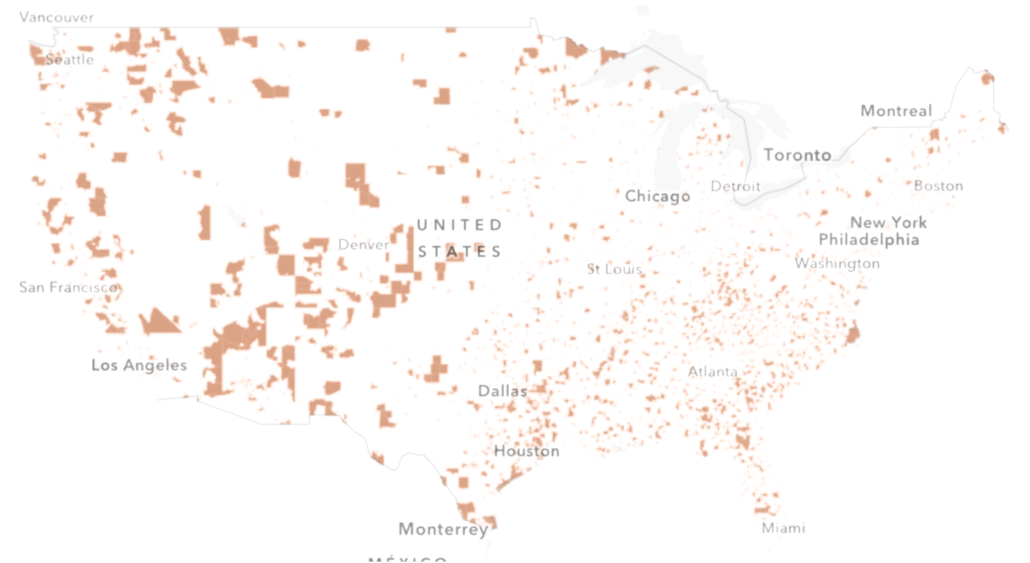

There are currently more than 8,860 designated OZs throughout the United States. This figure far surpasses the number of qualified communities in any past investment incentive program.

Opportunity Zones Bring Funds to Minority Communities

32 million Americans call opportunity zones home. Of those 32 million, the majority—an estimated 56%—are minority communities. In fact, 30% of those living in OZs are Latinx communities and 24% are African American. Further, 294 OZs fall on Native American lands.

OZs bring capital to areas that may otherwise be overlooked with the intention of revitalizing these areas and improving the lives of the people within them.

The Economic Benefits of Opportunity Zones Will be Long-Term

According to research conducted by the Tax Foundation, “opportunity zones were estimated to cost $1.6 billion in revenue from 2018 to 2027. New regulations stipulate that the program’s benefits would continue through 2047, meaning the program’s revenue impact could increase over time.”

Opportunity Zones Contribute to Environmental Development

In 2019, the United States Environmental Protection Agency (EPA) announced a $65 million grant project to rehabilitate environmental disaster areas within OZs.

What Are the Cons of Opportunity Zone Investments?

In contrast to the list of advantages, opportunity zone investments also have several disadvantages, including:

High Buy-in

The six-figure buy-in is not ideal for many investors.

OZs Aren’t a Short-Term Investment

If you’re looking for active, short-term investments, OZ funds aren’t for you. To earn the high rewards associated with these investments, you have to be willing to play the long game.

Limited Established Track Record

Opportunity zones were created in 2017 and, therefore, don’t have an established history for investors to review and determine risk. While OZs are associated with success thus far, high returns aren’t guaranteed.

Partner with Crivello Capital

At Crivello Capital, we’re focused on making communities better through capital investment. We buy large commercial real estate holdings in urban areas and opportunity zones.

We are focused on the positive impact capital can make in communities and the lives of business owners through:

- Direct investments

- Real estate investments, and

- Alternative lending

Our transparent process and horizontal hierarchy allow us a level of speed and flexibility unrivaled by other investors. Lastly, our no-nonsense approach brings clarity to the transactional world of corporate lending and investment.

Apply for capital with Crivello Capital or read on to learn more about our mission.