Venture capital and private equity are often lumped together because both terms refer to firms that invest in companies and exit by selling their investment. However, there are several technical differences between venture capital and private equity funding.

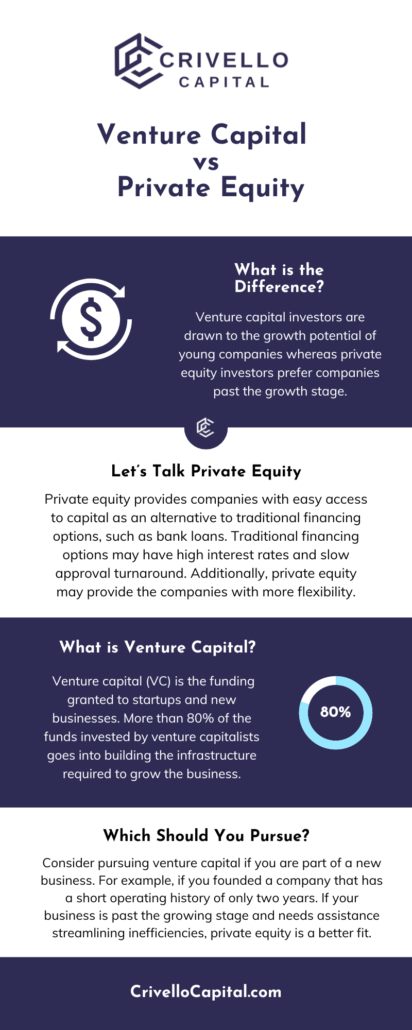

The main difference between venture capital and private equity lies in the business the investors choose to invest in. Venture capital investors are drawn to the growth potential of young companies whereas private equity investors prefer companies past the growth stage.

Let’s start with the definitions before we dive into how each works.

What is Venture Capital?

Venture capital (VC) is the funding granted to startups and new businesses. Technically, VC is a form of private equity. VC is often associated with small companies that display significant growth potential. Investors are drawn to the high rates of growth and high returns that a company may provide.

This high growth potential is often fueled by elements such as unique innovation or carving out a new industry niche.

Venture capital is an essential financing vehicle for startups because they may struggle to access funding sources due to their short operating history. VC gives these businesses capital and an opportunity to grow and build credibility.

How Does Venture Capital Work?

Harvard Business Review estimates that more than 80% of the funds invested by venture capitalists go into building the infrastructure required to grow the business. For example, investors may provide funds for marketing and manufacturing or invest working capital.

Additionally, investors may provide their expertise in the process of helping the company evolve. Further, VC investors tend to be well-connected and lead entrepreneurs to new opportunities.

Venture Capital is Not Long-Term

The purpose of venture capital is to help build a business’ infrastructure and balance sheet. Essentially, an investor invests in an entrepreneur’s idea, helps to grow rapidly, and exits. As we said, about 80% of the funds are allocated to the company’s adolescent stage.

Who Should Pursue Venture Capital?

Venture capital is an attractive option for new companies. For example, companies with a short operating history who are looking to expand their business.

Past the Growth Stage? Let’s Talk about Private Equity

Private equity (PE) is a source of investment capital that comes from high-net-worth individuals or firms that directly invest in private companies. These investments may take the form of:

- Purchasing stakes in private companies

- Acquiring control of public companies with plans to take them private and delist them from stock exchanges

How Does Private Equity Work?

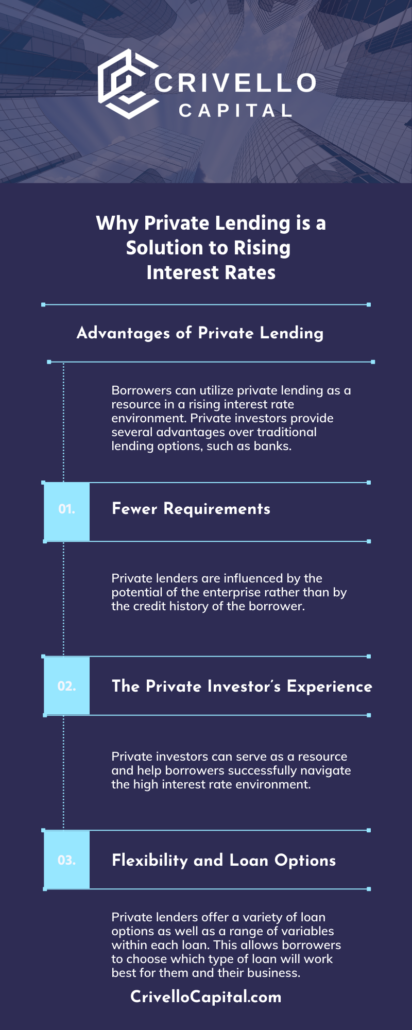

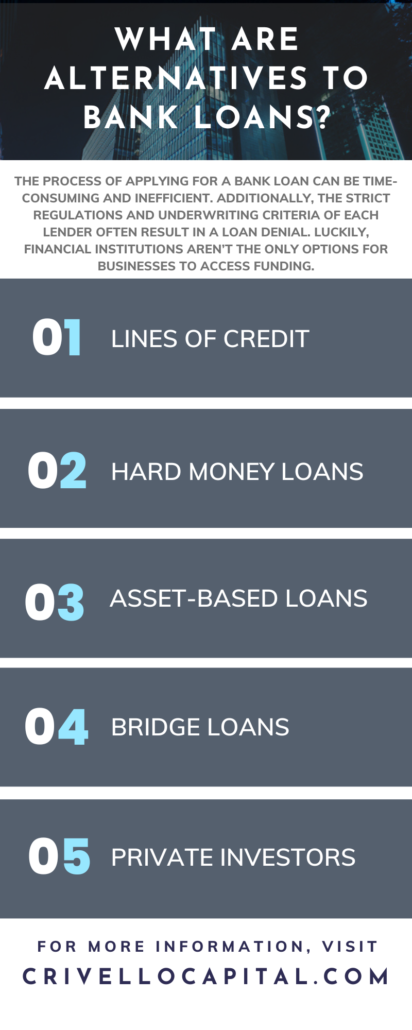

Private equity provides companies with easy access to capital as an alternative to traditional financing options, such as bank loans. Traditional financing options may have high-interest rates and a slow approval turnaround. Additionally, private equity may provide the companies with more flexibility.

For instance, companies have the flexibility to use the funding to:

- Fund new technology

- Increase working capital

- Stabilize a balance sheet

- Make acquisitions

Who Should Pursue Private Equity?

Private equity investors often choose mature, established companies. But why would these established companies need funding? Typically, private equity investors provide funds for companies that are failing to make a profit due to inefficiencies, such as issues with management or manufacturing.

However, companies do not have to be struggling or failing to receive private equity.

Looking For a Private Investor?

Crivello Capital is a private investment group focused on improving communities and impacting business owners’ lives through capital investment.

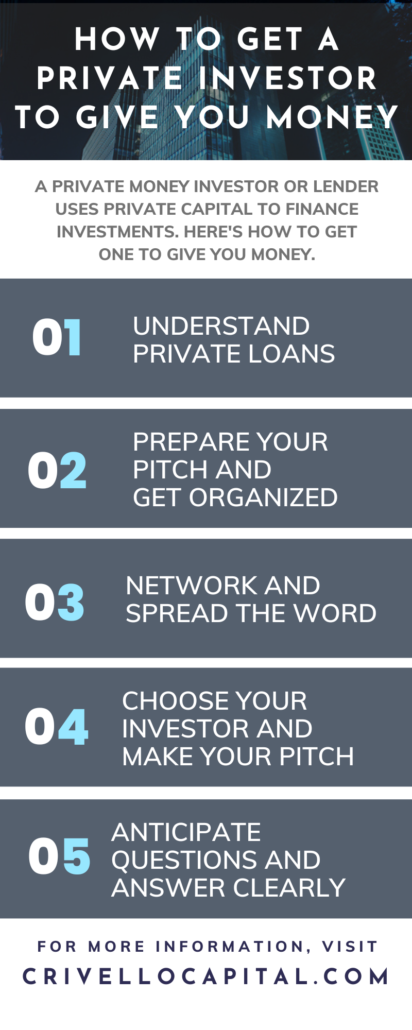

Wondering how to get a private investor to give you money? Lucky you, we have the answer right here.