Venture capital (VC) is a form of private equity that gives investors the opportunity to support the growth of startups and young businesses. VC is often associated with small companies that display significant growth potential.

While such investments can be considered risky, the high returns and rush of helping a startup succeed make venture capital popular among investors.

In fact, according to The Economist, global venture investment is on track to hit a high of $580 billion this year. This figure is almost 50% more than 2020 and is 20 times the VC invested just two decades ago in 2002.

The process of venture capital can be divided into five stages:

- Seed stage

- Startup stage

- Emerging stage

- Expansion stage

- Bridge stage

Let’s review these stages and how VC funds are used to grow businesses.

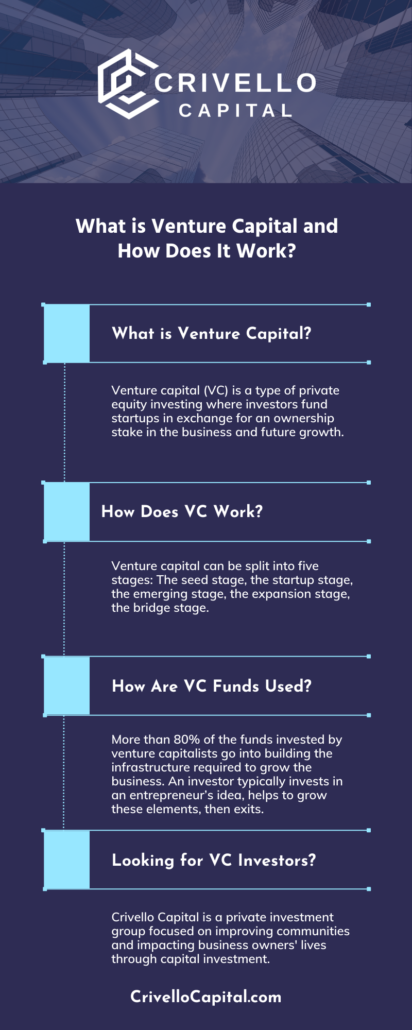

What is Venture Capital?

Venture capital (VC) is an attractive option for startups or companies with a short operating history.

It’s defined as “a type of private equity investing where investors fund startups in exchange for an ownership stake in the business and future growth potential.”

Why is Venture Capital Essential for New Companies?

Venture capital is a significant financing vehicle for new businesses and startups.

Why?

Because new businesses and startups, due to their short operating history, may struggle to access traditional funding sources.

Traditional financial institutions consider several factors in determining whether to offer a loan to a business.

These factors, both quantitative and qualitative, can include:

- Debt-to-income ratio

- Cash flow

- Collateral

- Industry

- Credit score

- Operating history

Many enterprises will not have these qualifications until later on in their business history and are, therefore, often denied loans from banks.

This leaves new companies with a gap in capital as they build their record and grow their company.

Venture capital fills this gap.

How Does Venture Capital Work?

Venture capital can be split into five stages. In all of these stages, venture capital investors assist with the growth of a business.

The Seed Stage

During this stage, the startup is an innovative idea lacking structure.

Typically, investments during this stage are small and used for expenses such as product development, marketing research, and business expansion.

The goals of the seed stage include creating a prototype or perfecting a service as well as attracting more investors to the venture.

VC can start with the seed stage but doesn’t have to. Some VC investors may begin funding the enterprise at this stage; however, many will join in later funding rounds after the product is developed.

The Startup Stage

In the startup stage, enterprises have developed their product and created a business plan. However, the startup hasn’t necessarily sold any products yet.

In this stage, entrepreneurs need access to funds to drive their business forward. These funds will allow the business to manufacture and market its product.

Investors may also offer their expertise in the process of helping the company evolve and lead entrepreneurs to new opportunities.

The Emerging Stage

The emerging stage, also referred to as the first stage, is typically the launch of the company. This is when the company will begin to see a profit.

The venture capital from this stage is often used to manufacture and market the product. Because of this, the investments during the emerging stage are usually much higher than in previous rounds.

According to Harvard Business Review, 80% of the funds invested by venture capitalists go into building the infrastructure required to grow the business.

The Expansion Stage

This stage, often referred to as the second and third stages, refers to when the company experiences exponential growth.

During this time, the enterprise will need additional funding to keep up with the demand for its products and services. The business will grow in various ways during this stage, such as with product diversification and market expansion.

Additionally, the company will likely begin seeing profitability and will utilize venture capital funding to create a stable, profitable future.

The Bridge Stage

The bridge stage is the final phase of VC financing. This stage is when the company has matured and established its infrastructure, product, and customer base.

Many venture capital investors may choose the bridge stage as the best time to sell their shares. After all, they have successfully achieved their goal of helping to build and grow this enterprise.

Looking for Venture Capital Investors?

Crivello Capital is a private investment group focused on improving communities and impacting business owners’ lives through capital investment.

At Crivello Capital, we partner with companies that require investment to build, grow, or obtain more inventory. Our goal is to be the source of capital business owners need, providing flexibility where banks are rigid, and common-sense standards of lending where other private lenders are bound by red tape from their boards.

Our process is simple. We rely on data, research, due diligence, and our capacity to see and understand business opportunities. We are agile, flexible, and straightforward.

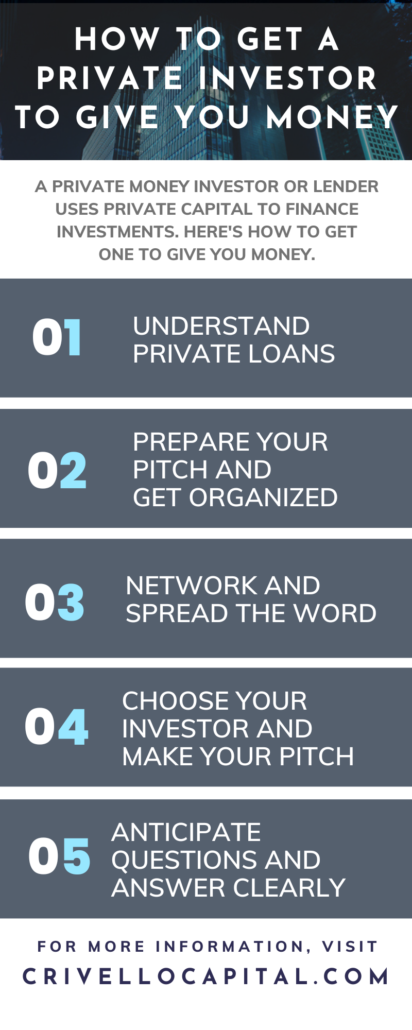

Read on to learn how we can help you build your business or apply for capital in four easy steps. Then, read on to learn how to find a private money investor.