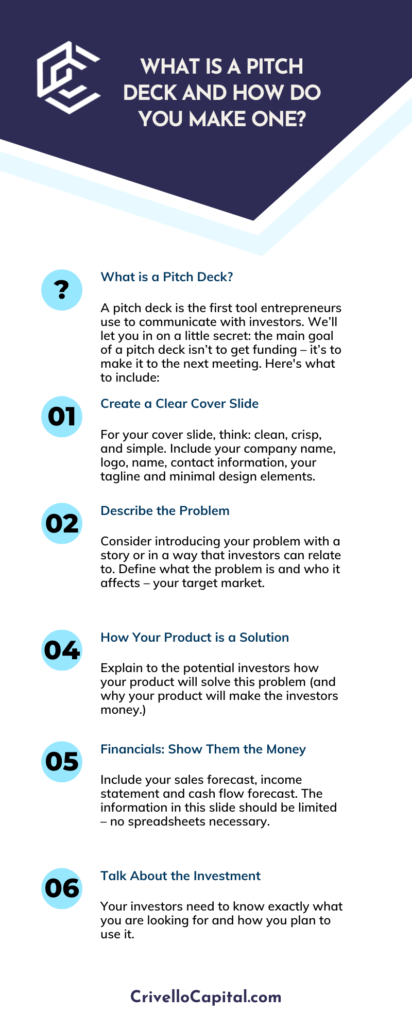

A pitch deck is the first tool entrepreneurs use to communicate with investors. First impressions are crucial and can make or break an opportunity. Your pitch deck should be designed to inform, intrigue, and excite investors.

We’ll let you in on a little secret: the main goal of a pitch deck isn’t to get funding – it’s to make it to the next meeting.

What is a Pitch Deck?

A pitch deck is a short presentation that entrepreneurs use to describe their business to potential investors. A pitch deck, also known as a start-up or investor deck, provides an overview of your business plan, products, services, and growth.

What to Include in a Pitch Deck (and How to Make it to the Next Meeting!)

Even if you have been communicating with investors prior to presenting your investor deck, this is your chance to take the connection to the next level. The information in your pitch deck should be accurate, concise, and up-to-date.

Create a Clear Cover Slide

For your cover slide, think: clean, crisp, and simple. Include your company name, logo, name, contact information, and tagline. Focus on minimal design elements that will intrigue investors without distracting from the essential information you are presenting.

Introduce Your Business

This is an important slide. You should introduce your business, what it does, and why investors should invest in it. Here’s the trick: keep it clear, confident, and short.

Describe Your Business in One Sentence

We challenge you to try to describe your business in a tweet: 140 characters or less in language that your parents would understand. For instance, “We’re the Tesla of the investment banking industry,” implies innovation, luxury, and success.

Additionally, businesses often include a specific unique value proposition in their first side.

Know Your Unique Value Proposition

A unique value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. The goal of this statement is to convince the customer that their product or service will add more value or better solve an issue than similar products or services.

Entrepreneurs include this information in a pitch deck to show investors why their product is different from others and how they will convince customers to buy it.

Describe the Problem Your Business is Solving

If your business isn’t solving a problem, you might have more issues than trying to put together a pitch deck.

Consider introducing your problem with a story or in a way that investors can relate to. They’ve likely seen all the stats before– what makes your product different?

Define what the problem is and who it affects.

Explain How Your Product is a Solution

Now that you’ve covered what the issue is and who it affects, you can explain to the investors how your product will solve this problem. This can also lead you to why your product will make the investors money.

Demonstrate What Your Product Does

Provide proof that your product works. Consider adding statements from clients, specific scenarios in which the product worked, and visual elements such as photographs, graphics, or video of a demonstration.

Present Your Business or Revenue Model

This is your opportunity to explain to potential investors how your business will make them money. Consider these questions:

- How much does it cost to make your product or provide your service?

- Is this amount at all flexible? If it is, how so?

- How much will you charge?

- How does this pricing compare to your competitors?

Expand on Your Business’ Target Market

In this slide, describe who your ideal customer is and how many of them there are.

Explain How You Will Market Your Product to Your Target Audience

Include a brief description of your marketing plans to provide insight for the investors on how you plan to sell your product. You may choose to divide your market into groups and offer different strategies for marketing your product to them.

For example, let’s say you are selling a foldable laptop and solving the problem of laptops being inconvenient to carry outside of the office.

You may target Generation Z consumers by showing an influencer taking this laptop from bed to a coffee shop to an airport to a hotel resort because Gen Z trusts influencers, travels the most out of any generation, and prioritizes flexibility in the workplace.

You may target millennials by appealing to their values because millennials often consider their social impact and want to align themselves with companies and products that are making a difference. In fact, 73% of millennials state that they are more willing to invest more in a product if it comes from a sustainable brand.

Investors will want to see this research as well as research specific to your target market and product. However, remember to keep it short and only present the most relevant information.

Provide Information About the Competitive Landscape

Answer some of the following questions:

- Who are your competitors?

- How do your competitors serve your target market?

- How does your product or service compare to the competition?

- What makes your product different from the rest of the competition?

- What advantages do you have over these competitors?

Financials: Show Them the Money

Include your sales forecast, income statement, and cash flow forecast. The information in this slide should be limited – no spreadsheets necessary. Limit yourself to profits, expenses, sales, and customers.

Additionally, try to keep any projections realistic. You don’t want to scare off investors by including an overly optimistic projection; you might just make yourself look like you don’t know what you’re talking about. Instead, use past data to accurately predict growth.

Talk About the Investment

Your investors need to know exactly what you are looking for and how you plan to use it. Further, include how the investment will help you to achieve your goals.

Other Tips to Make A Successful Pitch Deck

Present High-Level Ideas

Your pitch deck should include high-level ideas and an overview of your business. Avoid details that may distract from the main points you are trying to get across to the investors.

Tell a Story

Focus on a story over statistics. While statistics are important to include in your pitch, you want to avoid presenting an excessive amount. Too many numbers may make your pitch boring and distract from the numbers that matter the most.

Be selective with which statistics you include and tell a concise, relevant story with your pitch to help investors remember you.

Break Down Ideas

Try to limit yourself to discussing one idea per slide: what your product is, what the problem is, who the target market is, etc. Don’t shove multiple ideas into one slide if you find yourself with too many slides. Instead, look for information to cut out.

Keep Your Pitch Deck Between the Correct Length

Your presentation should be between 10 and 14 slides and never more than 20 slides. 10 is acceptable but may cause your slides to be too crowded, so we suggest somewhere in the 12 to 14 range.

What to Ditch in Your Deck: Elements Not to Include in Your Pitch Deck

Now that we’ve discussed what should be included in your deck, let’s talk about what shouldn’t. Here are a few examples:

- Overly detailed or distracting visuals

- Long paragraphs of text

- Spreadsheets

- Bullet points or long lists of statistics

- Small or hard-to-read fonts. That scrolly cursive might look cool on your computer, but an investor shouldn’t have to squint to read the information on your slide. Stick to large, basic fonts.

- Unnecessary details

- Too many slides. You want to keep the attention of the potential investors and respect their time.

Looking for Capital?

Apply now with Crivello Capital.

Crivello Capital is a privately held investment group. We focus on private credit and private equity investments in real estate, media, tech, and other business opportunities. We only pursue opportunities we believe provide attractive risk-adjusted returns. Learn more about our company and our mission, here.

Read on to learn how to find a private investor, here.